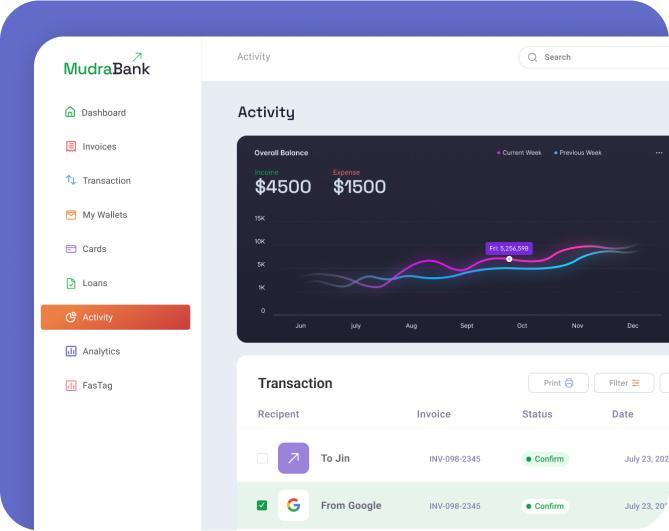

Fintech App Dashboard Design

for Digital Banking

- Mudra Bank

- Banking, Fintech

- Mobile App and Dashboard Design

- 1 UX Researcher, 1 UI Designer

- 3 Weeks

About Mudra Bank

Mudra Bank supports small businesses like vendors, tailors, and manufacturers. It aids small businesses in procuring loans and financial services that are usually hard to access through general banking systems.

The bank offers tailored loans, instant credit, financial literacy, and customized digital banking solutions for small businesses. Their powerful mission is to fuel financial inclusion and drive SMB growth. But they lacked a scalable digital tool to achieve it fully.

No app, no dashboard, no way for street vendors or rural tailors to access credit. They needed a platform that was as accessible and empowering as their vision. They needed a platform that was built for the real India.

Goal of The Design

Mudra Bank tasked us with creating a modern, secure, and user-friendly digital banking platform that connects millions of small businesses to the financial system. The design focused on simplifying digital banking and empowering entrepreneurs, rather than adding flashy custom features.

Our key objectives were to:

- Design a Platform that Felt Secure: Every fintech platform’s design needs to make its users feel that their finances are in safe hands. Every screen, every button, every interaction had to communicate security and reliability, thereby building user confidence from the moment users logged in.

- Make Banking Radically Simple: The app needed to be intuitive enough for a first-time smartphone user. Complex tasks like loan applications had to feel effortless. Everyone should be able to transfer money, pay bills, or check their account balance easily—even if they aren’t good with tech or money.

- Craft a Powerful Business Loan Application UX: Our goal was to help people apply for a business loan simply and confidently. The design needed to feel like a supportive partner. The journey from first contact to final approval had to be transparent and encouraging.

We weren’t just designing an app. We were designing a financial partner to help small Indian businesses thrive- a digital bank that fits in their pocket, a bank that speaks their language, a bank that believes in their businesses.

Challenges

Designing a banking app and dashboard from a blank slate is a monumental task. It requires more than just good technology. It requires a deep understanding of small-town Indian psychology towards money. We had to solve for trust, complexity, and the diverse realities of users across India.

The Trust Barrier

- Money is about trust—especially for a new digital bank. Our challenge was to convince small business owners, even in tier-2 cities, to trust an app with their livelihood. The design had to feel as secure and reliable as their local bank branch, instantly.

The Complexity Problem

- Loan applications are filled with endless forms and confusing jargon. Our challenge was to take these complex, multi-step financial processes and make them feel as simple as sending a text message. Our design had to eliminate friction and fear from the process. It had to slice through the complexity and design clear, guided pathways that anyone could follow without feeling overwhelmed.

The Digital Divide

- Our user base was incredibly diverse. A tech-savvy startup founder in Mumbai or a first-time digital user in a small town- the app had to work perfectly for both. We had to design an interface that was modern and powerful enough for the experts. Yet, simple and accessible enough for the novices.

Our design had to feel secure without being complicated. It had to feel simple without being basic. That was the tightrope we had to walk.

Our Approach

Discover: Listening to the User

We studied how small business owners in India feel about using digital tools — their needs, fears, concerns, and goals. During our ethnographic studies and in-person interviews, we also investigated common user concerns like

This research informed our strategy for content hierarchy and user flow.

- The fear of hidden fees.

- The urgent need for quick loan approvals.

- The critical importance of local language support.

For the target users, a digital bank meant partnership and opportunity—not just transactions. They needed confidence more than cutting-edge features.

These human insights became the foundation of our entire design strategy.

Define: A Design Language of Trust and Empowerment

We built the brand’s identity from scratch, inspired by “Mudra” as a symbol of trust and currency. A deep blue conveyed stability, while saffron and green reflected growth, prosperity, and national pride. The visual language was clean.

We also designed a custom icon set. This set makes key in-app actions simple and instantly recognizable for users with low digital or financial literacy.

At every chance, we replaced large patches of text with these custom icons. A rupee symbol for payments. A clock for transaction history. Every element was designed to communicate one thing: “This is a real bank. A safe space. Your money and your business are safe here.”

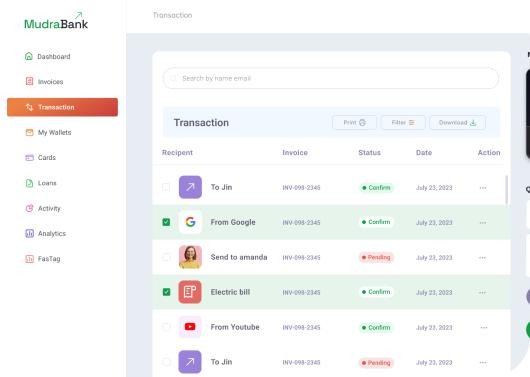

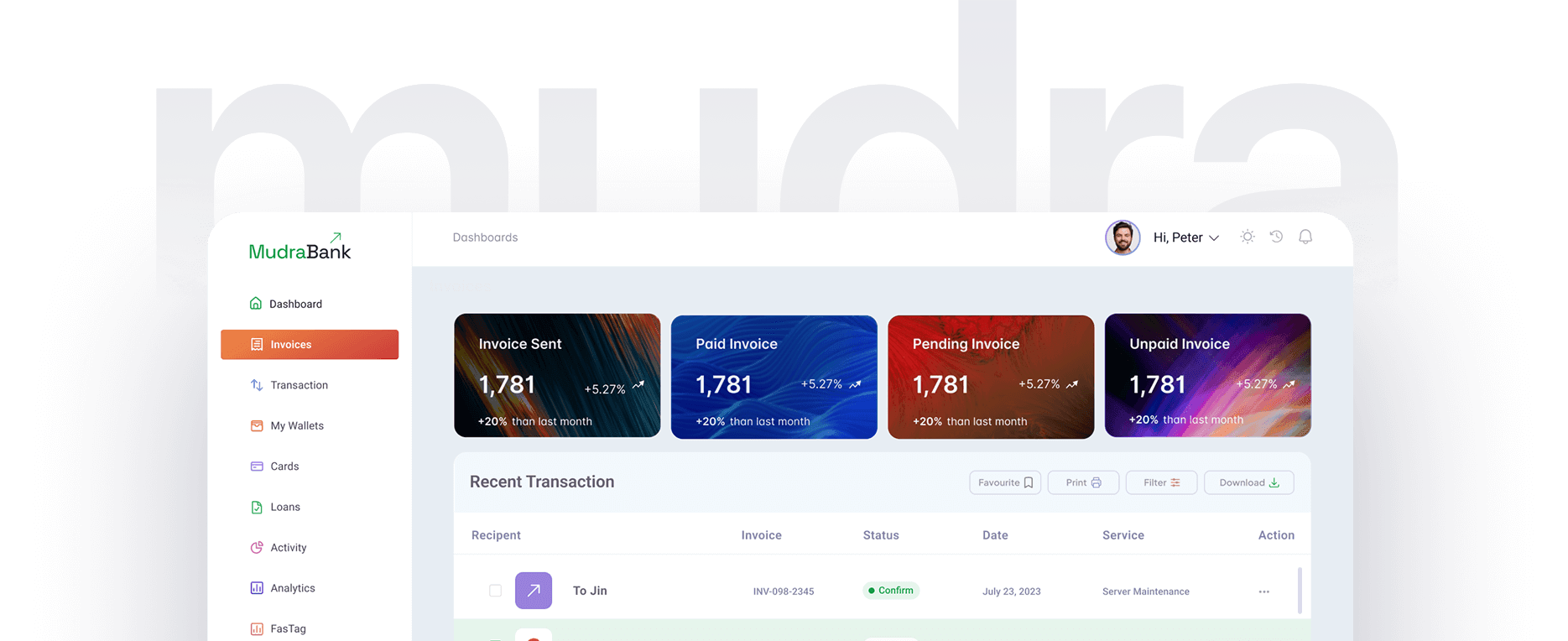

Design Highlights

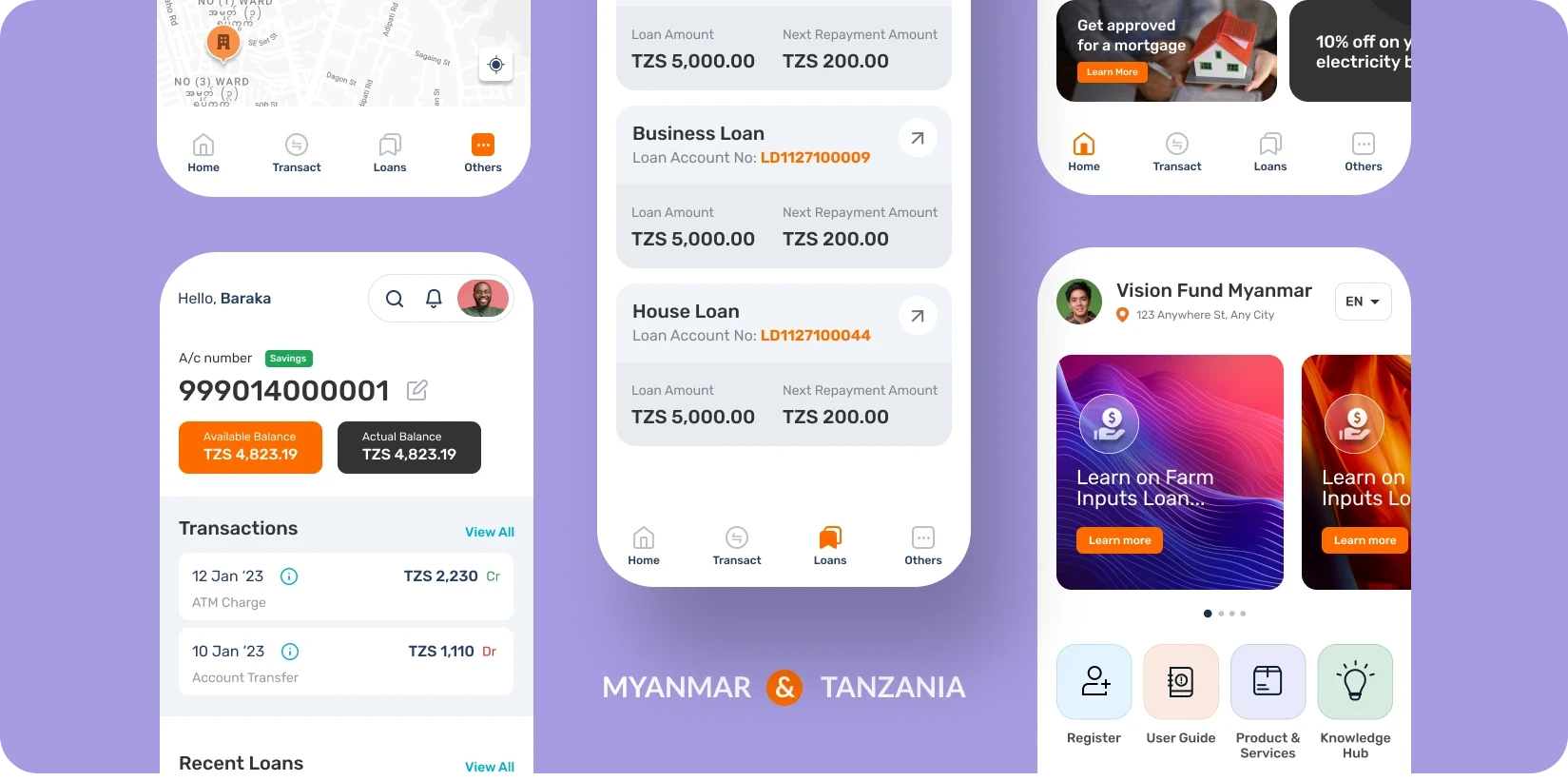

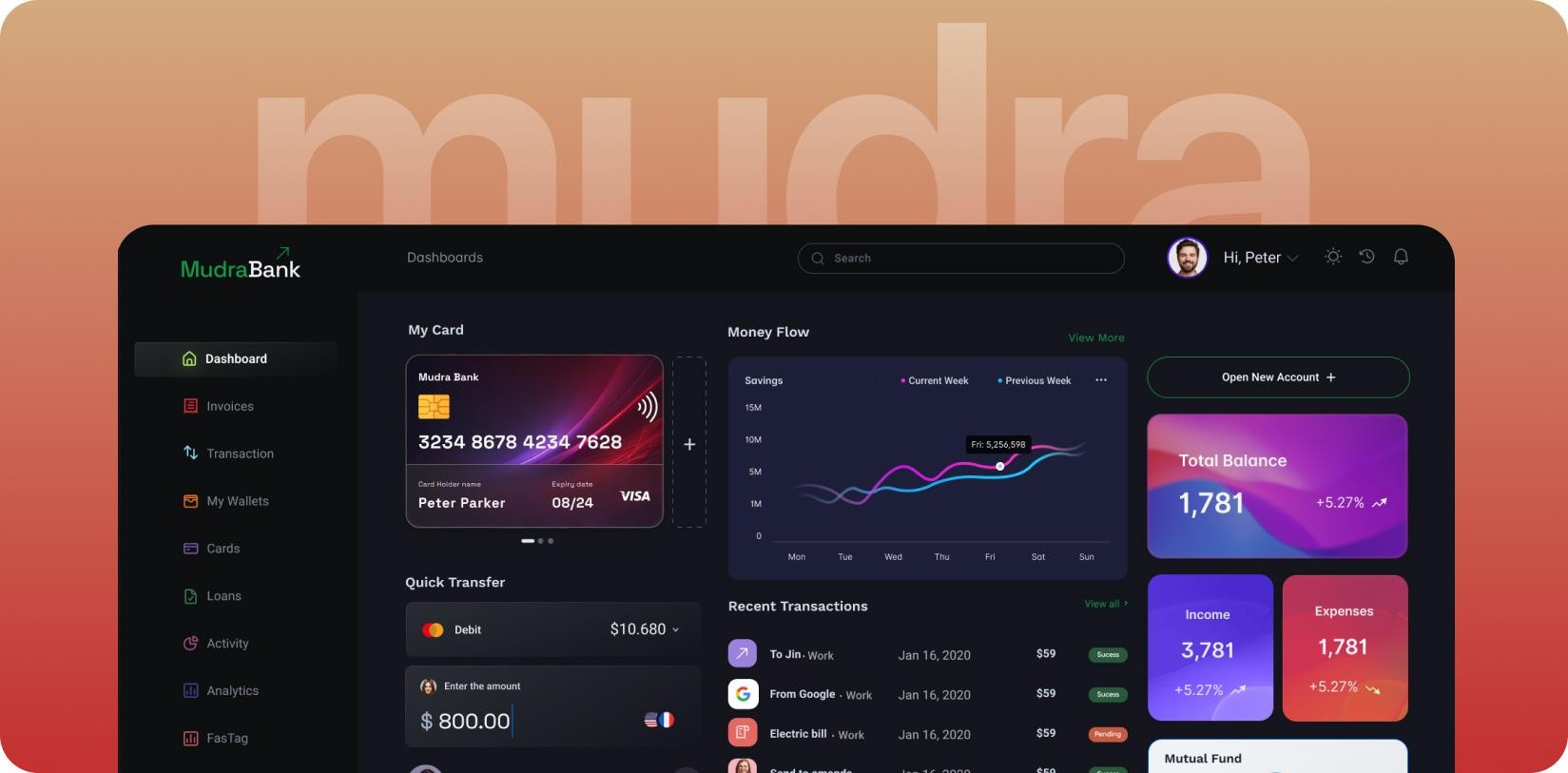

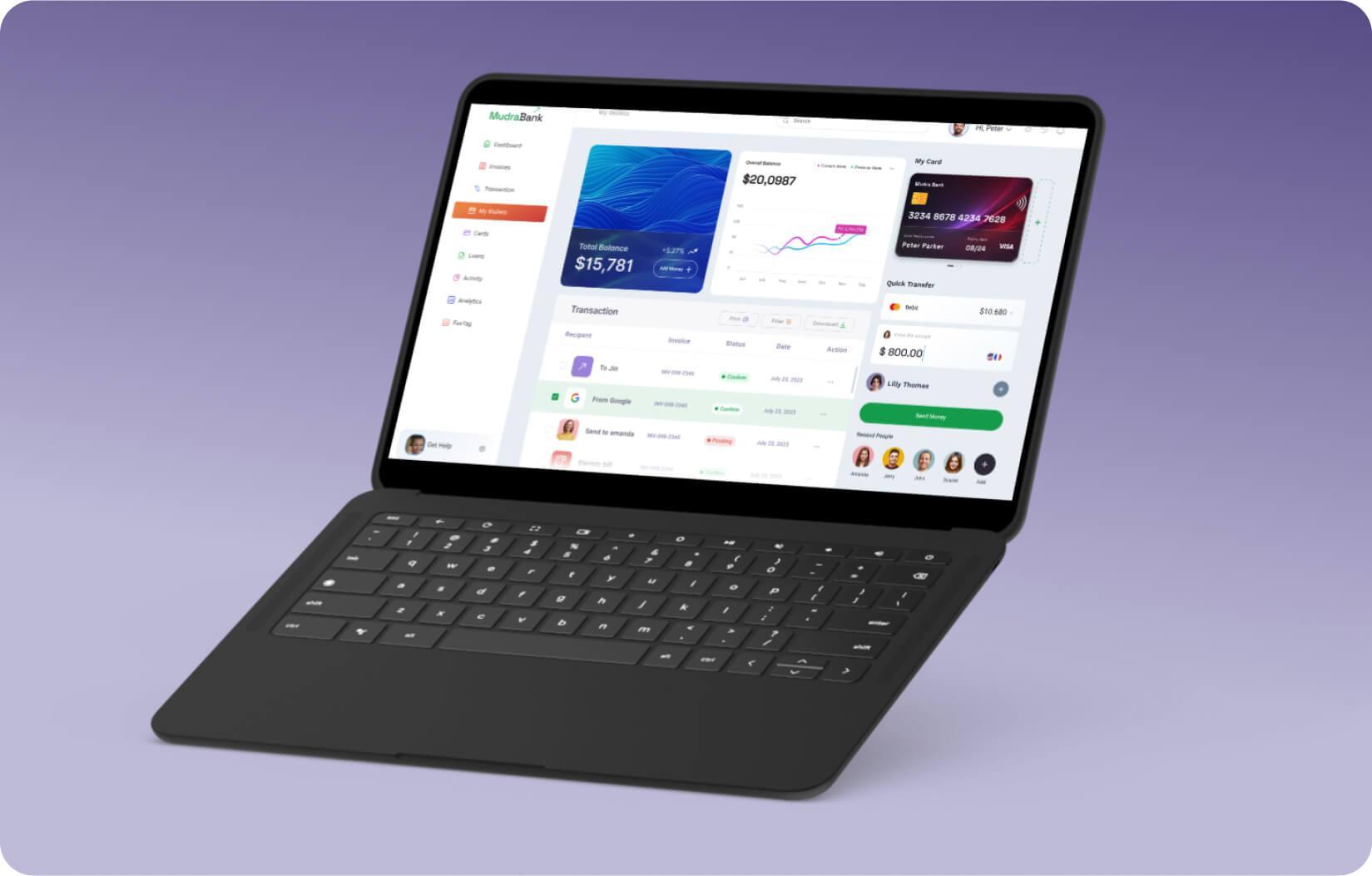

We designed a clean, intuitive mobile interface that simplifies core banking tasks. We focused on making the entire experience feel empowering and easy to navigate.

- The app has structured dashboards for both individual and business users. They provide clear, one-glance overviews of accounts, transactions, loan payment-related notifications, etc. They make financial data easy to understand.

- We integrated guided workflows for complex processes like loan applications. The design breaks down the application into simple, step-by-step stages. Clear instructions and progress indicators at every step reduce friction and build user confidence.

- The app UI’s text and intuitive icons make key features instantly accessible. Anyone can instantly access the app’s core features like ‘Pay,’ ‘Transfer,’ and ‘Save.’

Applying for a loan now feels like a simple, respectful conversation. Not an interrogation. Each step is clear, and each requirement is simple. Just confirm and submit pre-filled forms using Aadhaar data without any typos or passwords to remember. Toggle for switching from English, Hindi, Tamil, Telugu, or other languages ever-present in the header.

A human-centered blueprint turned a digital bank idea into a trusted platform for millions of businesses.

- Confident Financial Management: The app empowers thousands to manage savings, transactions, loans, and financial planning.

- Reduced Friction and Anxiety: Step-by-step flows simplify banking, fueling exponential loan application growth and completions.

- A Foundation for Growth: With an easy-to-use design and scalable system, Mudra Bank is built to serve 50,000+ businesses and expand further.

Mudra Bank’s secure, intuitive platform fosters financial inclusion, empowering small businesses to confidently access, manage, and grow their finances.

Final Product Showcase

The app design for the Mudra Bank is a powerful tool for economic empowerment and guides its development and digital strategy. We support the team with interactive prototypes, focusing on flawless implementation of the guided loan application to maintain user trust. User testing scripts for the beta launch will gather feedback on the dual-dashboard experience. The icon set and color palette are expanding to support new financial literacy modules.

Future plans include a ‘Community’ feature for peer support and a ‘Growth Tracker’ to visualize progress. This evolving platform aims to deliver secure, accessible banking to India’s small businesses, marking a new chapter in digital finance.

![Thumbnail One]()

![Thumbnail Two]()

- Watch video on dribble.